Swing trading is a popular strategy for short-term traders who aim to capture gains in a stock or other financial asset over a period of a few days to a few weeks. The goal of swing trading is to take advantage of short-term price movements in the market, without getting caught up in the long-term trend. For more information about swing trading, you may visit biticodes Here are some strategies for successful swing trading:

Identify the trend: One of the most important aspects of swing trading is identifying the trend. You should be looking for stocks that are trending upward or downward, and then look for opportunities to buy or sell when the stock is in a swing or consolidation phase.

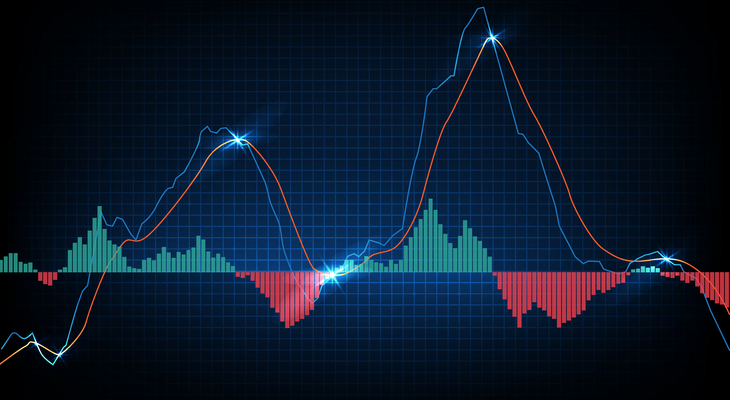

Use technical analysis: Technical analysis is a popular tool for swing traders, as it allows them to identify potential entry and exit points based on past price movements. Traders may use tools such as moving averages, trend lines, and chart patterns to identify potential trade opportunities.

Set stop-loss orders: Stop-loss orders are essential for swing traders, as they allow you to limit your losses if the trade goes against you. It’s important to set stop-loss orders at a level that is reasonable for the specific stock or asset you are trading.

Keep an eye on market news: Swing traders should stay up-to-date with market news and events that could affect the stocks or assets they are trading. This information can help you make more informed trading decisions and avoid unexpected market movements.

Click here – How Often Should You Replace Your Pillows?

Day Trading: Pros and Cons of Trading in One Day

Day trading is a popular strategy for short-term traders who aim to make quick profits by buying and selling stocks or other financial assets within a single trading day. While day trading can be profitable, it is also associated with significant risks. Here are some pros and cons of day trading:

Pros of day trading:

Quick profits: Day trading allows you to make quick profits by taking advantage of short-term price movements in the market. With the right strategy and timing, you can make significant gains in a single day.

Low overnight risk: Unlike swing traders, day traders do not hold positions overnight, which means they are not exposed to overnight market risk. This can be an advantage for risk-averse traders.

Tight stops: Day traders typically use tight stop-loss orders to limit their losses if the trade goes against them. This allows traders to control their risk and minimize their losses.

Cons of day trading:

High risk: Day trading is associated with high risk, as traders are exposed to sudden and unexpected market movements. This can result in significant losses if the trader is not careful.

Stressful: Day trading can be extremely stressful, as traders need to make quick decisions and be constantly monitoring the market. This can lead to burnout and emotional exhaustion.

Requires discipline: Successful day trading requires discipline and a strict trading plan. Traders need to be able to stick to their plans and avoid the temptation to make impulsive trades based on emotions or rumors.

Click here – Investment Strategies for Ethereum – A Guide to Dollar-Cost Averaging and Swing Trading

Conclusion:

Both swing trading and day trading can be profitable strategies for short-term traders, but they each have their advantages and disadvantages. Swing traders aim to capture gains over a period of a few days to a few weeks, while day traders aim to make quick profits within a single trading day. Swing traders use technical analysis and set stop-loss orders to manage risk, while day traders use tight stop-loss orders and need to be disciplined and focused. Ultimately, the best strategy for you will depend on your risk tolerance, trading goals, and personal preferences. It’s important to do your research and develop a solid trading plan before getting started with either strategy.

In addition to the strategies and pros and cons mentioned above, traders need to remember that both swing trading and day trading require a certain level of experience and skill. It’s not enough to simply have a trading plan and the right tools – traders need to have a deep understanding of the market and the specific stocks or assets they are trading. They also need to be able to manage their emotions and avoid making impulsive decisions based on fear or greed. With the right mindset, discipline, and experience, traders can find success with either swing trading or day trading.